All Categories

Featured

Table of Contents

If you are, an instant annuity may be the finest alternative. No issue what option you pick, annuities help offer you and your household with monetary safety.

Warranties, consisting of optional advantages, are backed by the claims-paying capability of the company, and might include constraints, consisting of abandonment costs, which may impact policy values. Annuities are not FDIC guaranteed and it is feasible to shed money. Annuities are insurance policy products that require a premium to be spent for purchase.

Please contact an Investment Professional or the issuing Firm to obtain the prospectuses. Please review the prospectuses thoroughly prior to investing or sending out cash. Financiers must think about financial investment objectives, danger, fees, and expenses meticulously before spending. This and other vital information is contained in the fund programs and summary programs, which can be acquired from a financial professional and need to be reviewed carefully before investing.

Annuity Guys Ltd. and Client One Stocks, LLC are not affiliated.

Speak to an independent insurance representative and inquire if an annuity is best for you. The worths of a repaired annuity are guaranteed by the insurer. The warranties use to: Payments made collected at the rates of interest applied. The cash value minus any fees for moneying in the plan.

Taken care of annuity interest prices offered change consistently. Some fixed annuities are called indexed. Fixed-indexed annuities use development capacity without stock market danger.

Highlighting What Is A Variable Annuity Vs A Fixed Annuity Everything You Need to Know About Variable Annuities Vs Fixed Annuities What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Is a Smart Choice Fixed Annuity Vs Equity-linked Variable Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Key Features of Indexed Annuity Vs Fixed Annuity Who Should Consider Immediate Fixed Annuity Vs Variable Annuity? Tips for Choosing Annuity Fixed Vs Variable FAQs About Choosing Between Fixed Annuity And Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Indexed Annuity Vs Fixed Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Vs Variable Annuity Pros And Cons

They aren't guaranteed. Money can be moved in between subaccount funds without any kind of tax obligation repercussions. Variable annuities have attributes called living advantages that provide "disadvantage defense" to capitalists. Some variable annuities are called indexed. Variable-indexed annuities provide a level of defense versus market losses chosen by the investor. 10% and 20% disadvantage defenses prevail.

Taken care of and fixed-indexed annuities often have during the abandonment duration. The insurance business pays a fixed price of return and soaks up any type of market risk.

Variable annuities additionally have revenue options that have guaranteed minimums. Others choose the assurances of a fixed annuity earnings.

Analyzing Strategic Retirement Planning Key Insights on Annuity Fixed Vs Variable Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Fixed Index Annuity Vs Variable Annuity Can Impact Your Future How to Compare Different Investment Plans: How It Works Key Differences Between Annuity Fixed Vs Variable Understanding the Risks of Long-Term Investments Who Should Consider Retirement Income Fixed Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Deferred Annuity Vs Variable Annuity A Beginner’s Guide to Pros And Cons Of Fixed Annuity And Variable Annuity A Closer Look at How to Build a Retirement Plan

Variable annuities have numerous optional advantages, however they come at a price. The expenses of a variable annuity and all of the alternatives can be as high as 4% or more.

Insurance firms supplying indexed annuities provide to protect principal in exchange for a restriction on growth. Fixed-indexed annuities ensure principal. The account value is never ever much less than the original purchase payment. It is very important to bear in mind that abandonment charges and various other fees might use in the early years of the annuity.

The development capacity of a fixed-indexed annuity is normally much less than a variable indexed annuity. The development capacity of a variable-indexed annuity is typically higher than a fixed-indexed annuity, but there is still some threat of market losses.

They are fit to be a supplemental retired life cost savings plan. Below are some points to take into consideration: If you are adding the optimum to your workplace retirement strategy or you don't have access to one, an annuity may be an excellent option for you. If you are nearing retirement and require to produce guaranteed earnings, annuities offer a selection of options.

If you are an active financier, the tax-deferral and tax-free transfer attributes of variable annuities may be eye-catching. Annuities can be an essential part of your retired life plan.

Breaking Down Annuities Variable Vs Fixed A Closer Look at Tax Benefits Of Fixed Vs Variable Annuities Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Deferred Annuity Vs Variable Annuity Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Vs Variable Annuities FAQs About Choosing Between Fixed Annuity And Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Variable Annuity Vs Fixed Indexed Annuity

Any info you provide will just be sent to the agent you choose. Sources Consultant's guide to annuities John Olsen NAIC Customers guide to delayed annuities SEC guide to variable annuities FINRA Your Guide To Annuities- Variable Annuities Fitch Ratings Meanings Moody's score scale and meaning S&P International Understanding Ratings A.M.

Finest Monetary Score Is Very Important The American University of Count On and Estate Advice State Study of Property Security Techniques.

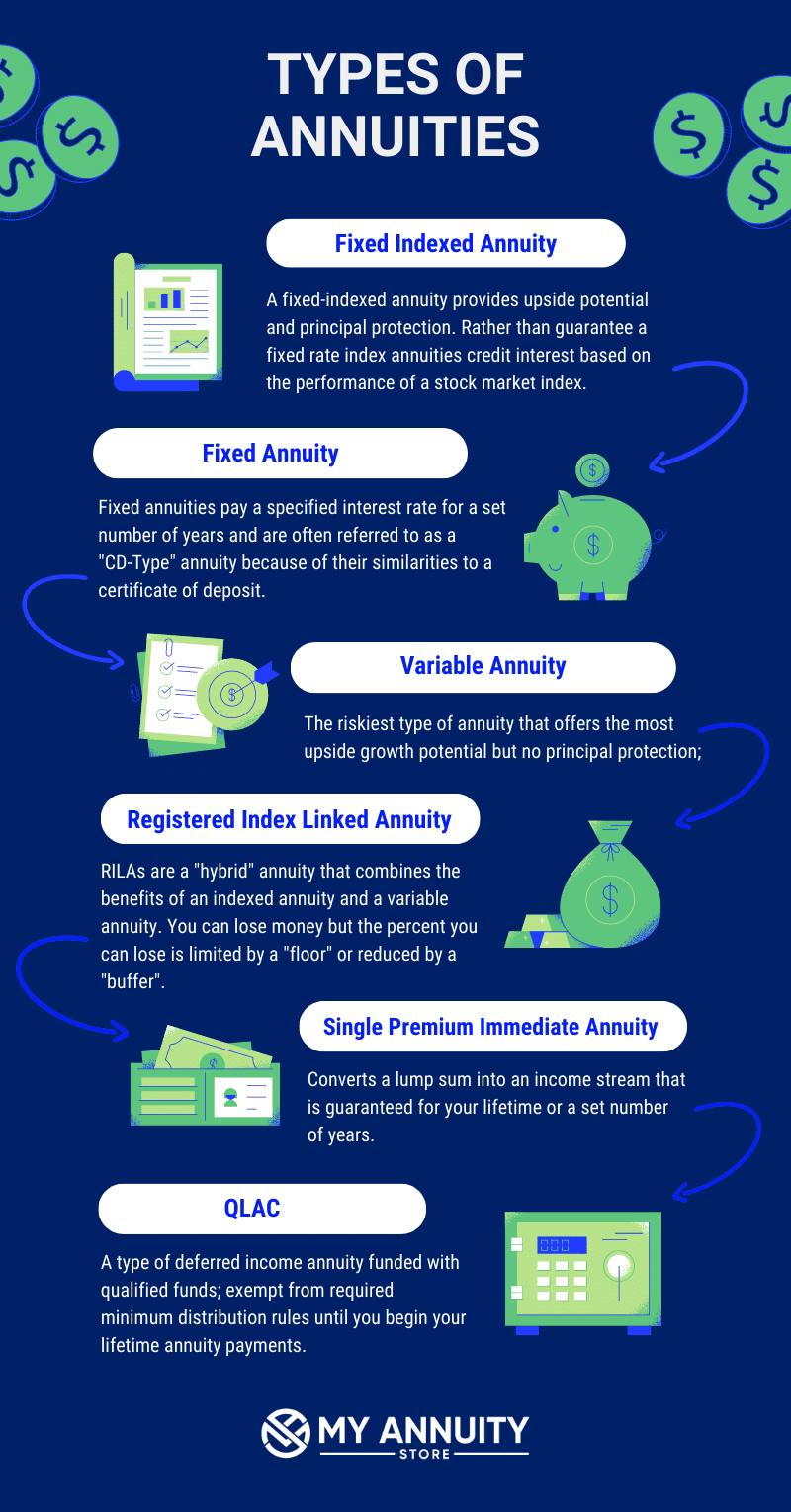

An annuity is an investment alternative that is backed by an insurer and offers a series of future payments for present-day deposits. Annuities can be very customizable, with variants in passion prices, premiums, tax obligations and payments. When choosing an annuity, consider your distinct requirements, such as the length of time you have prior to retirement, just how rapidly you'll need to access your cash and exactly how much tolerance you have for threat.

Exploring the Basics of Retirement Options A Closer Look at Variable Annuities Vs Fixed Annuities Defining Fixed Annuity Or Variable Annuity Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: How It Works Key Differences Between Fixed Annuity Or Variable Annuity Understanding the Rewards of Long-Term Investments Who Should Consider Annuity Fixed Vs Variable? Tips for Choosing Variable Vs Fixed Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Interest Annuity Vs Variable Investment Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

There are several various kinds of annuities to choose from, each with one-of-a-kind attributes, risks and incentives. Considering an annuity?

All annuities are tax-deferred, suggesting your rate of interest earns rate of interest till you make a withdrawal. When it comes time to withdraw your funds, you might owe taxes on either the complete withdrawal amount or any kind of passion accumulated, depending on the kind of annuity you have.

During this time, the insurance firm holding the annuity disperses regular settlements to you. Annuities are provided by insurance business, financial institutions and other economic institutions.

Fixed annuities are not attached to the changes of the stock market. As a result, repaired annuities are taken into consideration one of the most reliable annuity options.

With a variable annuity, you'll pick where your payments are spent you'll typically have low-, modest- and risky alternatives. Consequently, your payments increase or lower in connection to the efficiency of your picked profile. You'll obtain smaller payouts if your investment chokes up and larger payouts if it does well.

With these annuities, your payments are connected to the returns of one or even more market indexes. Numerous indexed annuities likewise come with an assured minimum payout, comparable to a repaired annuity. Nevertheless, in exchange for this additional defense, indexed annuities have a cap on just how much your investment can gain, also if your selected index does well.

Analyzing Annuity Fixed Vs Variable Everything You Need to Know About Fixed Vs Variable Annuities Defining the Right Financial Strategy Advantages and Disadvantages of Fixed Vs Variable Annuity Why Variable Vs Fixed Annuity Is a Smart Choice How to Compare Different Investment Plans: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Indexed Annuity Vs Fixed Annuity? Tips for Choosing the Best Investment Strategy FAQs About What Is A Variable Annuity Vs A Fixed Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding What Is Variable Annuity Vs Fixed Annuity A Beginner’s Guide to Pros And Cons Of Fixed Annuity And Variable Annuity A Closer Look at Variable Vs Fixed Annuity

Right here are some benefits and drawbacks of different annuities: The primary advantage of a fixed annuity is its predictable stream of future revenue. That's why fixed-rate annuities are frequently the go-to for those intending for retirement. On the other hand, a variable annuity is less predictable, so you won't receive an ensured minimum payment and if you select a risky investment, you could also lose cash.

But unlike a single-premium annuity, you generally won't be able to access your payments for years ahead. Immediate annuities provide the option to receive earnings within a year or more of your investment. This might be an advantage for those dealing with imminent retired life. Nevertheless, funding them typically requires a large amount of money up front.

Latest Posts

Inherited Annuity 1035 Exchange

What Happens To An Annuity Upon Death

Athene Annuity Life Assurance